Data Labeling — How Data Annotation Service Helps Build a Smarter Finance Industry?

Smart Finance

With the large-scale commercial application of deep learning and computer vision technology, the combination of the financial industry and artificial intelligence has become more closely, and the wave of intelligent finance has begun to sweep the whole financial industry.

From product design to customer service, From external management to internal monitor, artificial intelligence technology has a clear landing scenario in each of the financial industry value chains, effectively reducing the operating cost and financial risk.

Behind the ecological reshaping is the breakthrough in AI technology. Computer vision, voice interaction, and natural language processing are more closely integrated into the financial industry, and the application of these technologies cannot be apart from the data annotation industry.

Computer Vision

In the financial industry, computer vision is mainly used in the field of internal process optimization, customer interaction service, face recognition, object detection.

Such technology provides simplicity and convenience, for example, face swiping for fast payment. The previous method is that the user enters the password before paying. The process is relatively complicated, and there is a password leak problem. This interactive mode not only simplifies the payment process and improves the degree of automation, but also greatly improves the user’s payment experience.

This kind of computer vision technology requires different annotation types, such as key points, 2D boxing, etc. As it involves sensitive information such as the human face image, people are concerned about data security. Therefore, it is an important capacity for data annotation service providers.

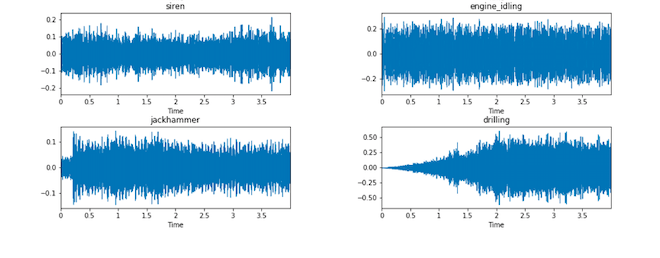

Voice Interaction

In the financial industry, especially in bank institutions, the staff always communicate with clients. There are a variety of scenarios, such as business consulting, customer service, and electronic marketing.

Trending AI Articles:

1. Top 5 Open-Source Machine Learning Recommender System Projects With Resources

4. Why You Should Ditch Your In-House Training Data Tools (And Avoid Building Your Own)

At present, many financial institutions are equipped with voice interaction technology. And customer service robots are the most typical ones.

For example, a question answering system (QA) is a kind of chatbot that can automatically answer human questions in natural language. Understanding voice is an only half process, and the other is giving responses and answers. The competitive advantages of chatbots are communication simplification and labor cost reduction.

Due to the great differences in terms and expressions in different scenes, and the language in different places, there are high requirements for the scenario-based and customized data annotation capabilities of data annotation service providers.

Natural Language Processing

Applications of natural language processing include semantic analysis, information extraction, text analysis, machine translation, and so on. In the financial industry, the main application scenarios are text checks, information search, language robots, etc.

For example, through semantic analysis of the text content, the intention is analyzed, and the response is finally formed through text synthesis. The main data annotation types are sentiment analysis, Text &Speech classification, OCR.

The integration of artificial intelligence has profoundly changed the traditional financial industry and reshaped the new ecology. In the future, with the development of artificial intelligence technology, there will be more vertical applications in finance.

Data Labeling Service

Just as a triangle needs three sides to stabilize its shape, artificial intelligence will also need all three elements to perfect itself. In fact, getting high-quality labeled data is the toughest part of building a machine learning model.

ByteBridge, a human-powered data labeling tooling platform with real-time workflow management, providing high-quality data with efficiency.

Individually decide when to start your projects and get your results back instantly

Clients can set labeling rules, iterate data features, attributes, and task flows, scale up or down, make changes.

Clients can monitor the labeling progress and get the results in real-time on our dashboard.

These labeling tools are available on the dashboard :

Image Classification, 2D boxing, Polygon, Cuboid

For further information, please visit the website:ByteBridge.io

Don’t forget to give us your ? !

![]()

How AI builds a smarter Finance industry? was originally published in Becoming Human: Artificial Intelligence Magazine on Medium, where people are continuing the conversation by highlighting and responding to this story.